GST 2.0: The Future of India’s Taxation System

India’s taxation journey has evolved into a tremendous leap since the inception of the Goods and Services Tax (GST) in 2017. Now, with the announcement of GST 2.0, all business owners, taxpayers, and professionals are eager to know what is changing, how it will work, and most importantly, how it will affect them.

This comprehensive guide will explain all about GST 2.0: its key peculiarities, benefits, challenges, and compliance requirements. If you are operating a business or in the finance services, an update on this is not just important but essential for survival and growth.

What Is GST 2.0?

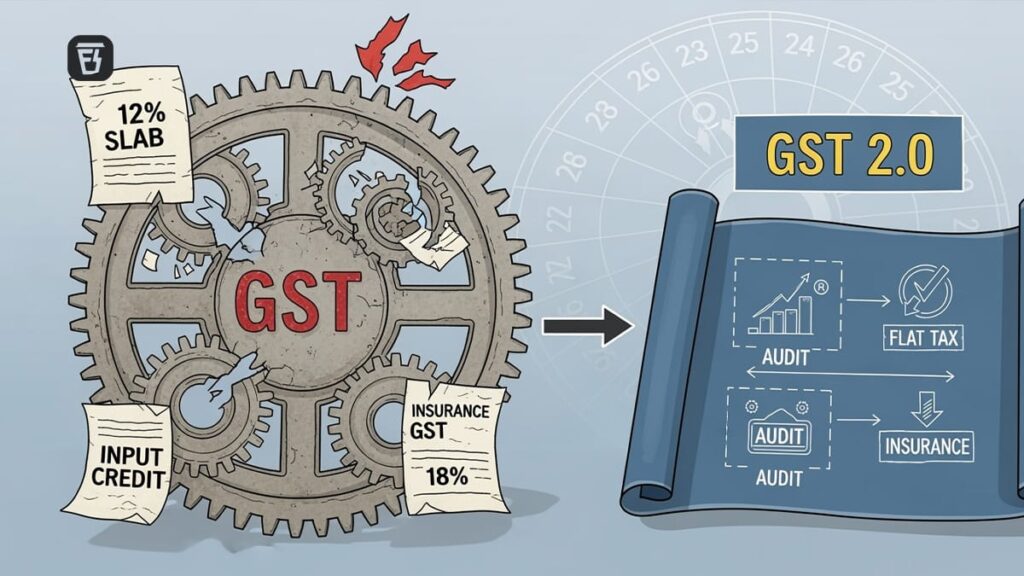

It is touted as India’s next-generation tax structure. While GST 1.0 bundled indirect taxes into one single unified system, they are primarily focused on simplifying compliance, making processes more transparent, and technology-led enhancements.

The aim is to make filing of GST easier for businesses while also ensuring higher tax compliance and greater revenue collection. Simply put, it is an upgrade to an already existing GST system that is more intelligent, swift, and friendly to businesses.

Why Was There a Need for GST 2.0?

The revolutionary concept of GST rather had a few snags for some businesses, especially the MSMEs, such as-

- Complicated return filing process.

- Mismatch of the input tax credit (ITC).

- Technical glitches on the GSTN portal.

- Multiple deadlines leading to confusion.

With this, the government will hopefully offer some relief by bringing in automation, real-time invoice matching, and straightforward filing procedures.

Key Features of GST 2.0

1. Simplified GST Return Filing

Arguably the biggest promise of GST 2.0 has been to institute one monthly return for most taxpayers. This single return will replace many multiple filings, such as GSTR-1, GSTR-3B, etc., thus easing the compliance burden.

2. Real-Time Invoice Matching

There have been many input credit mismatches under GST 1.0 for many business houses. Under this, there will be an auto-population of invoice data that would reduce many errors and fraudulent situations.

Using artificial intelligence and blockchain, it would eliminate fake invoices and evade tax, thus ensuring transparency and security.

4. Enhanced ITC Management

Businesses will be in a position to have a smooth credit of input tax and thereby facilitate smoother cash flows.

5. User-Friendly GSTN Portal

The new GSTN system will provide a quicker interface, support on mobile phones, and lesser downtime during the filing seasons.

Benefits of GST 2.0

It would be a boon for taxpayers and government:

- For Businesses: Less paper work, faster filing, diminished compliance burden.

- For Startups & MSMEs: Simplified registration and filing process.

- For Government: Enhanced tax collections with diminution of evasion.

- For Consumers: Stable pricing and reduction in cascading effect of taxes.

Challenges in GST 2.0 Implementation

Even it seems to have a promising outlook; still challenges remain at the implementation stage:

- Businesses need to upgrade the accounting software.

- Professionals need to be trained on the new compliance rules.

- The small businesses will probably struggle with digital adoption.

- Some hiccups are expected at the beginning on the GSTN portal.

GST 2.0 vs GST 1.0

| Feature | GST 1.0 | GST 2.0 |

| Return Filing | Multiple forms | Single simplified return |

| Invoice Matching | Manual reconciliations | Real-time auto-matching |

| Technology | Limited automation | AI + Blockchain integration |

| Portal | Frequent glitches | Improvements in GSTN system |

| Input Tax Credit (ITC) | Errors common | Seamless ITC flow |

Compliance Requirements Under GST 2.0

| Requirement | Details |

| Digital Records | Businesses must maintain all invoices and documents in digital format. |

| Upgraded Accounting Software | ERP/accounting systems must support GST 2.0 features like auto-invoice match. |

| Timely Return Filing | Monthly return filing on time to avoid penalties. |

| Internal Audits | Regular audits to ensure compliance and error-free filing. |

| Staff Training | Finance and tax teams should be trained on GST 2.0 rules and processes. |

How Businesses Can Prepare for GST 2.0

- Upgrade to GST-ready Software.

- Train the finance team on new rules.

- Mock filings should be conducted to test the process.

- Stay updated with government notifications.

- Leverage technology for GST 2.0.

Technology is going to be the backbone of GST 2.0. AI-powered invoice verification and blockchain-enabled security systems would lead to a lesser number of mismatches and faster compliance from taxpayers.

Conclusion

GST 2.0, as an upcoming milestone, will mark the growth of India’s taxation. Through simpler compliance procedures, real-time invoice-matching, and technology-based transparency, the system would increasingly offer a smoother experience for the taxpayer and better governance for the country.

Frequently Asked Questions

1. What is the biggest change in GST 2.0?

Moving to a single simplified return filing system with real-time invoice matching.

2. How will it affect small businesses

MSMEs will have reduced compliance burdens but would have to embrace digital solutions.

3. Is it going to be mandatory for all taxpayers?

The moment it is implemented, it will become the replacement to the existing framework of GST.

4. Will GST rates change in GST 2.0?

It might have the same structure, but compliance and filing would become easier.

5. What can I do to prepare my business for GST 2.0?

Update your software, train your staff, and Consult experts.